Best Invoicing App For Small Businesses Wave Financial

Allow your customers to pay your invoices immediately via credit card, secure bank payment (ACH/EFT), or Apple Pay. Create beautiful invoices, accept online payments, and make accounting easy—all in one place. You can mark invoices paid on the spot, so your records are instantly up to date.

Best Free Accounting Software for 2024

Wave invoices are integrated with our free accounting software, so payments are recorded and categorized for you - which means less bookkeeping and tax season prep. Set up recurring invoices and automatic credit card payments for your repeat customers and stop chasing payments. Features include quotes and estimates, automatic recurring orders and invoices, 20 different reports, sales tracking, income statements, and purchase orders. The software lacks in the customer service field, and we found the interface to be a bit abrasive when compared to other systems like Wave, but overall, we found the features to be respectable for a cost-free option. Features include unlimited invoices, bills, customers, and vendors (but no estimates), as well as support for multiple currencies to go with all those languages.

Wave Customer Service

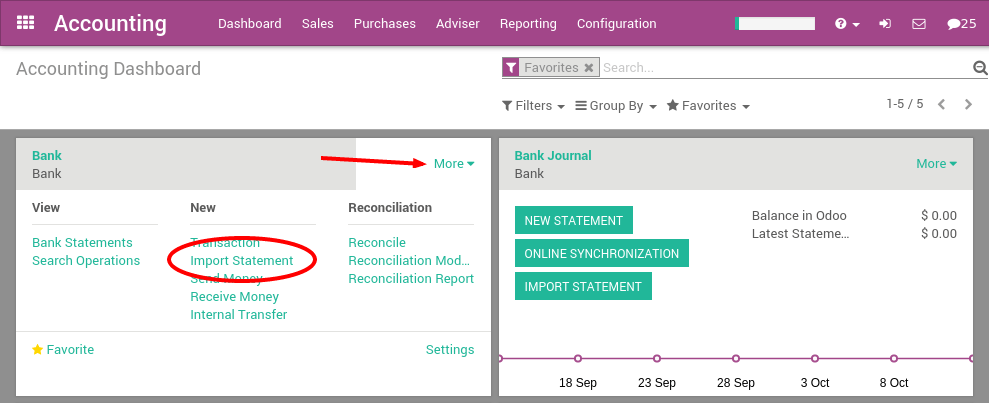

Other common tools, like online bank connections, help speed up the reconciliation process. And make sure to consider integrations — free accounting software should be compatible with how you choose to accept payments. Free business software can be the right choice if it covers your financial, https://www.quickbooks-payroll.org/ payroll, inventory, sales or other needs. The best choice will depend on your specific industry, budget and growth trajectory. But if a free product doesn’t make it easier to run your business, a paid option will likely be the better choice to save you time and help ensure accuracy.

Mobile app and cloud access

Choosing the right church accounting software is important, but it’s only one part of the equation. Nonprofit accounting differs from general business accounting, and so it’s crucial to work with an accountant or bookkeeper who understands nonprofit accounting in general and church accounting in particular. After conducting an initial exploration to identify the most relevant, popular, and established tools in the market, we put them through their paces with hands-on testing to see their real strengths and weaknesses.

Ratings and Reviews

With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike. We’ve already hit on a few accounting features that set Wave apart, but there are a few more perks to cover. Today’s leading accounting platforms offer standard security features, such as data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. You can invite your accountants, bookkeepers or other business partners to Wave via email and designate their user roles.

- In our last review, we found these features especially appealing because they were all completely free with no artificial limits.

- Accounting features are considered an add-on to any plan and come at an additional cost.

- Wave Accounting gives you free unlimited invoices, users, expense and income tracking, credit and bank account connections, and more.

- It also has excellent reporting features and a capable mobile app as well as a customizable dashboard that lets each user rearrange or hide panels according to their preferences.

- Check out our comparisons among these top three accounting software options to find the right fit for your business.

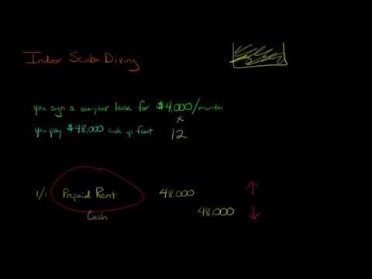

And FreshBooks doesn’t limit your user number, but it does charge an extra $10 a month per user—which adds up fast. If you’re a startup, micro-business or sole proprietor who doesn’t want to invest in accounting software but needs to keep track of your finances, Wave Accounting is a great option. As long as you’re content with basic features and don’t see yourself expanding in the foreseeable future, you’ll find this completely free, easy-to-use software particularly appealing. Since you don’t have to pay anything to get started, it’s certainly worth trying out. The free plan includes accounting basics such as bank reconciliation, a chart of accounts and expense tracking, plus helpful invoicing features. In particular, church staff may appreciate the ability to schedule recurring invoices for donors who give regularly and the ability to send donation receipts and thank yous.

Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance. She has also held editing roles at LearnVest, a personal finance startup, and its parent company, Northwestern Mutual. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Also, Wave Accounting only offers self-serve customer support. If you have a question or issue, you can browse the help center or reach out to Mave, the automated chatbot.

Xero is another reliable product when it comes to standard accounting capabilities. It also has excellent reporting features and a capable mobile app as well as a customizable dashboard that lets each user rearrange or hide panels according to their preferences. Free plan capped at 25 invoices per month and can track no more than 25 products or services. Wave offers its own payroll software and payment processing, but you can’t integrate with third-party options. Sally Lauckner is an editor on NerdWallet's small-business team.

The rate that you charge for your freelancing services can vary, so it's important to get a grasp of market trends before sending your clients an invoice or quoting a price. Freelance rates can differ depending on experience level and industry. For example, the rate a freelance web developer charges may be different than that of a freelance graphic designer, because each freelancer specializes in a different area.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Climate change has been called the biggest threat to global public health in the 21st century. I have been focused what is the allowance method on the health effects of climate change for more than a decade, and it seems that we have finally reached an inflection point. The vast majority of surveyed clinicians (80%) say their health systems should be working to address climate change and its impact. The report includes insight gathered from frontline health care workers, program leaders, health system advisors, policy and advocacy professionals, and community leaders.

However, Xero doesn’t have a free plan, with monthly subscriptions starting at $15. With limitations on Xero’s lowest-tier plans, users will have to upgrade to a more expensive option to take advantage of everything the software has to offer. Xero also doesn’t support multiple businesses, so pricing can add up quickly for some users. And it’s worth noting that while Xero has more features, the software also has a steeper learning curve than Wave.

Includes a free mobile app (iOS and Android) for church staff and full congregation. If you want to know not just where your business has been, but where it’s going, forecasting can help you out. It will take the numbers and data of the past and use that to project possible trajectories, allowing you to prepare for drier sales periods, or get excited about an upcoming influx of customers. And considering 95% of organizations with effective forecasting make quotas, compared to only 55% without, it’s safe to say this kind of tool can make a big difference. The platform is easy to use, with customer service provided by the company. Our research found that Wave is ideal for freelancers and accountants alike.

Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see /about to learn more about our global network of member firms. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business.

The same plans help speed up the inventory count process by allowing businesses to use mobile devices as barcode scanners. And unlike some competitors that only track single https://www.accountingcoaching.online/what-is-a-tax-expense/ inventory items, QuickBooks Enterprise lets you track inventory parts plus assemblies. You can also track the cost of goods sold and adjust inventory for loss or shrinkage.